Expand Your Portfolio Without Personal Income

REAL ESTATE INVESTMENT FINANCING MADE SIMPLE

No tax returns, no DTI calculations, no employment verification – just faster closings and greater opportunities

You can read my reviews, contact me via phone or email, or schedule a call below.

Want to request a term sheet or proof of funds letter now? Take 3 minutes to enter your deal info by clicking one of the 5 loan types and get a FREE quote!

Industry-Leading Fix and Flip Loan Program

No loan payments with financed reserves

Advanced draws for experienced flippers

Up to 90% of purchase and 100% of construction

Check to see if you qualify!

The EASY Button for Hard Money

With 14 years of experience as a rental real estate investor, I specialize in helping investors access Private Money Loans in order to scale efficiently. I can connect you with Fix & Flip, DSCR Purchase or Refinance, Bridge, Second Mortgage Cash Out, and Ground Up Construction Loans. Take the first step by filling out the quick survey above with your deal details to get started with a term sheet.

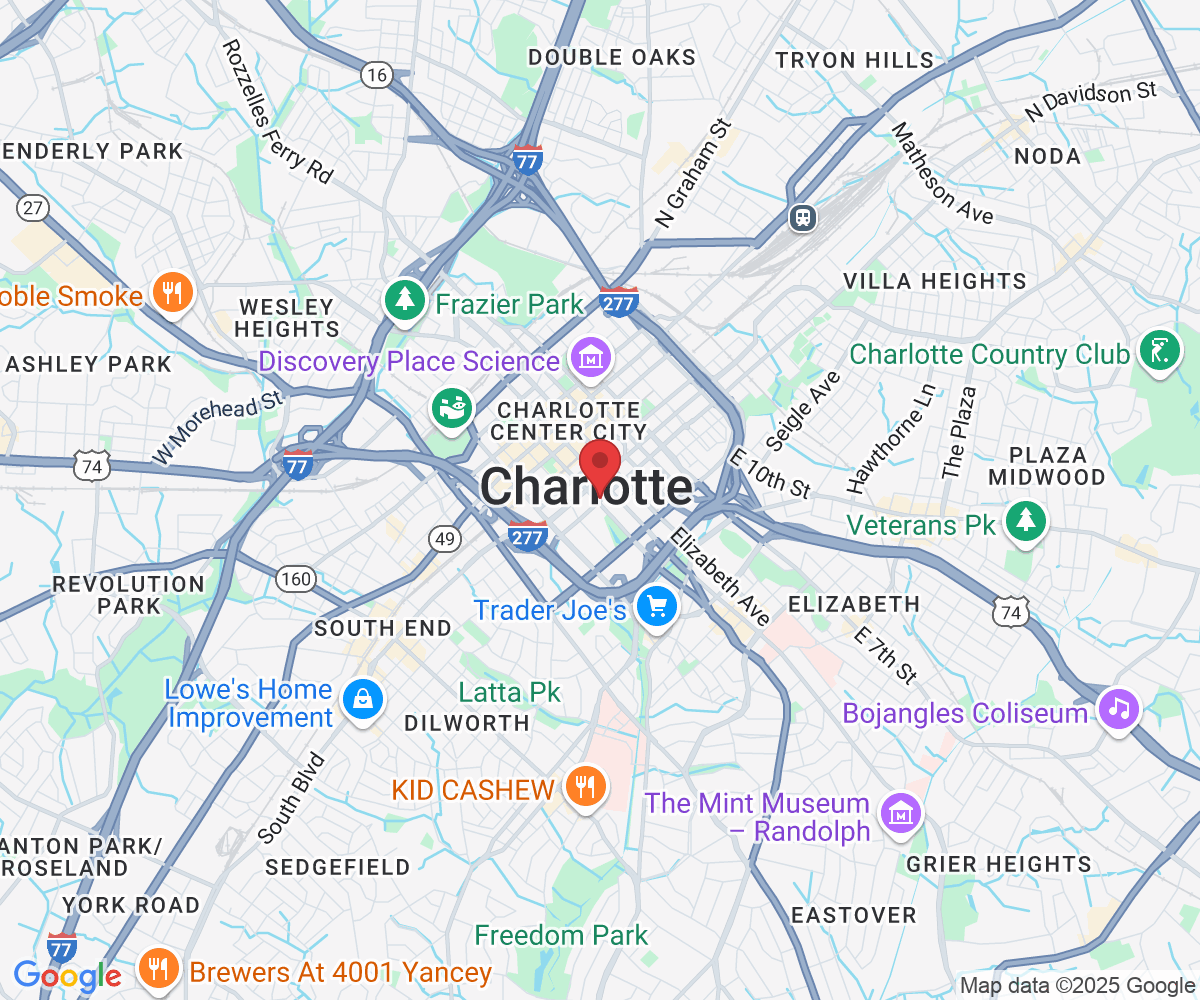

Based in Charlotte, NC, I offer creative solutions and multiple loan types primarily in the Carolinas and surrounding states, with loans available in 47 states.

Whether you’re a flipper, landlord, or builder, I invite you to apply for a loan and join one of my evening webinars designed to help you navigate the real estate market with confidence.

For those interested in transactional funding, business credit or credit stacking consultation, please reach out via email or phone to inquire about what solutions will best fit your needs.

I proudly work with referrals and look forward to helping you achieve your real estate goals.

All the best,

A. Whited

Frequently Asked Questions

What documents do I need to get a loan?

You’ll need our simple PDF loan application and disclosures, stamped articles of formation for your new or seasoned LLC, LP, or Corporation, an operating agreement or bylaws which you can amend, property insurance, a credit report, title report and appraisal. I will order these last 3 items for you. You do NOT need proof of personal or business income, a personal financial statement, or tax returns, and we do not ask about your employment. In many cases, you do not need seasoned assets or bank statements. Specific requirements vary by program.

How quickly will my loan be funded?

COE is realistically about 15 business days: estimate 5 days for appraisal and title, 5 days for quality review and final loan terms, and 5 days for legal documents and wire. Please be sure everyone is on board with this timeline. On a purchase you could write the offer as 10-15 days and keep a 10-15 day extension in mind because Realtors deal in calendar days and lenders deal in business days.

Testimonials

Working with Asia has truly been a positive experience. She communicates clearly and professionally, which sets her apart from others in the field. Her deep understanding of the lending process is evident, and her team is always prompt and helpful in their responses. I highly recommend reaching out to her for your financing needs.

— Julieann F.

Asia is my go-to for anything real estate investing. She knows her stuff and always brings solid insight to the table. She's got a mind full of strategy and a heart full of hustle. Whether I'm tackling a new investment idea or weighing financing options to scale my REI business, Asia's the first call I make, and usually the only one I need.

— Jeff G.

© Copyright Access Creative Solutions 2026. All rights reserved.

Access Creative Solutions LLC is a credentialed private money, hard money and DSCR broker working with preferred lenders who are licensed (i) by the Financial Division of the California Department of Business Oversight as a California Finance Lender and Broker under DBO license #60DBO-73498, (ii) by the Department of Financial Institutions of Arizona as a Arizona Mortgage Banker under License # BK-1004278, (iii) in Minnesota as a Residential Mortgage Originator under License #MN-MO-1835832, (iv) maintains its Residential First Mortgage Notification status in Utah through the Utah Department of Financial Institutions, (v) by the Division of Financial Regulation of Oregon as an Oregon Mortgage Lender under License # ML-5871 and (vi) by the Nevada Division of Mortgage Lending as a Mortgage Company Licensee* under License # 5168. *It should be noted that in the state of Nevada some of Moving Forward Properties LLC services may not be available to Nevada customers.

*Rates, terms and conditions offered apply only to qualified borrowers in accordance with our guidelines at the time of application, property factors and geography and are subject to change at any time without notice. This is a non-binding expression of interest and does not create any legally binding commitment or obligation on the part of Aceess Creative Solutions LLC or its affiliates and are subject to credit, legal and investment approval process. Some of the links in this post are affiliate or joint marketing links and Access Creative Solutions may earn a commission. Our mission remains to provide valuable resources and information that helps real estate investors finance and manage their investment properties efficiently and profitably. We link to these companies and their products because of their quality, not because of the commission. By clicking our links you agree to receive marketing material by us or our affiliates and joint marketing partners.